The Gold Rush: Are Giant Companies Taking Over 3D Printing?

Introduction

First, it was Autodesk with its own Ember 3D printer, then HP making a disruptive announcement in late 2014. After that, Ricoh and Canon presented their own powder and resin-based 3D printers. Now, Polaroid launched its own desktop machine, with Apple and Google investing heavily both in 3D scanning and rapid, full-color 3D printing technologies. Microsoft, with its Hololens, is not far behind.

It seems the time has come for the big boys to start looking at the 3D printing market. But, as new as this may seem, it is not a new trend at all. In fact, UK government research shows that during the ’90s and early 2000s, some of the largest companies in consumer technology – such as Samsung, NEC, Philips, and Fujitsu – were assigned dozens of patents relating to 3D printing. That has not necessarily translated into 3D printing going mass market.

Will it ever? Almost certainly yes– let’s see some of the reasons why.

Before that, however, we have to clear out a few myths. For example, the fact that “consumer 3D printing is dead”. The idea came after the perceived failures of Stratasys and 3D Systems, the two current 3D printing industry leaders, in making a serious dent in the consumer market through their MakerBot and Cubify platforms. There are many reasons why that has not happened and we are not going to look into them now. The one main reason, though, is that the time for mass consumer 3D printing has not come yet. The time for desktop 3D printing, on the other hand, is ripe.

Let’s consider this: MakerBot sold some 90,000 desktop 3D printers and it was considered a failure. On the other hand, if any of the hundreds of 3D printing startups all over the world were to sell more than 500 units a year, it would be a huge success for them. It is all a question of expectations. These numbers are not sufficient to interest the giants of consumer electronics, but they are more than sufficient to fuel the growth of a highly fragmented – and rapidly evolving – global market.

At the same time, the 3D printing markets that are beginning to attract the interest of multinational giants are the B2B and, especially, B2C segments. This is where Autodesk first, then HP, Canon, Ricoh, and more companies will focus their activities, with the next wave of consumer (C2C) 3D printing led by those companies that today are starting to address the shift from virtual to physical: Apple and Google.

Autodesk leads the pack

So what are these companies doing and what are their perspectives? Let’s go in order.

The first large company (over $2.5 bln in yearly revenue) to enter the 3D printing hardware market was Autodesk, by acquiring a small startup at work on the Ember DLP 3D printer and 3D printing platform. For Autodesk, one of the largest publishers of 3D modeling/CAD software in the world, it was mainly a way to gain a better understanding of 3D printing, in order to develop better software.

For this reason, the company released the 3D printer at a very affordable price and released all technical specifications under an Open Source license. This project may not have been highly profitable for the company yet, but it is an important investment towards what Autodesk calls the “Future of Making Things”.

The HP way

The next big company to enter the 3D printing arena, this time with a real bang, was HP in late 2014. Although HP’s Multi Jet Fusion (MJF) technology promises to be truly revolutionary (faster printing, stronger parts, multi-color, and multi-material), as of now it is still just a promise.

The company made clear that the 3D printer – which is meant to address the needs of large, professional digital 2D printing services – would not come out until 2016. It is widely expected to hit the market this year.

However HP, like Google and Apple, understood that the revolution of 3D printing needs to go through a revolution in the acquisition of 3D data. That is why it also launched the Sprout desktop 3D scanner, which enables users to easily create 3D models of objects. Right now, these can be 3D printed through online 3D printing services such as Sculpteo, though in the future they may also be 3D printed at home.

Down to Earth

Other large companies took a slightly more down-to-earth approach. Japanese giant Ricoh (about $18.5 bln in yearly revenue), for example, saw 3D printing as a perfect component for its office supplies business and began from early on a distributive partnership with Dutch professional desktop 3D printer manufacturer Leapfrog.

As the industry evolved, Ricoh understood that the real money, today, is in offering small-scale serial B2B and B2C manufacturing through selective laser sintering technology (SLS). So it built and presented its own SLS 3D printer, the AM S5500P.

Another Japanese giant (over $30 bln in early revenue) also saw 3D printing as a natural extension of its core activities. Canon, which is active primarily in the photography, 2D printing, and projector/video camera business, announced a new, resin-based 3D printer together with a “mixed reality” headset.

The company has probably understood that in the not-so-distant future, the idea of 3D photos and thus that of physical photos will become a mainstream business.

Polaroid, a much smaller company but with a highly recognizable brand, also began to venture into the desktop 3D printing segment by forming a partnership with EBP Group, a large UK company, active in manufacturing of inkjet cartridges for 2D printing, which had developed and launched its own desktop 3D printing system. This operation will begin to show us if the power of brand is enough to get consumer truly interested in 3D printing.

Mass market 3D scanning and 3D printing

Two companies that may be interested in finding out how the Polaroid experiment will turn out are Apple and Google. While Google can experiment more freely through its often hardware agnostic platforms, Apple is known to invest into a product only when this is truly ready to offer a fully satisfactory consumer experience as well as unit sales at least in the hundreds of millions. That is why both companies are taking a similar and yet opposite approach to 3D.

They are both interested in 3D printing and 3D data acquisition technologies. In 2014, Apple bought PrimeSense, the Israeli company that invented the affordable 3D scanning technology powering the Kinect platform. Apple is now rumoured to introduce the 3D double camera functionality into its iPhone 7 due out in late 2016.

As far as 3D printing goes, other than the fact that Apple has made intensive use of professional 3D printers for prototyping of new product from the very beginning, the only known project so far for desktop 3D printing is the registering of a patent for a proprietary color 3D printing technology.

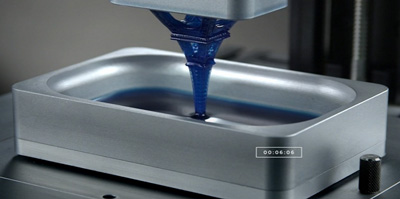

Google is definitely ahead on both fronts. Its 3D vision technology, dubbed Project Tango, has already been extensively beta tested and will soon be available on Lenovo smartphones. On the 3D printing front, the company has invested as much as $100 mln on Carbon3D’s CLIP technology, a type of Continuous-DLP super fast 3D printing technology, which promises print speeds up to 25 faster than current resin-based AM processes.

Looking at the future in 3D

Microsoft, finally, was among the first to implement 3D printing support into its software. Nonetheless, the company has not made any significant moves on the hardware front nor on the 3D data acquisition front. With its Hololens system, it seems set on leading the way into the intermediate field of 3D visualisation, the virtual world in which 3D data is handled and modified, before being sent to the 3D printer for materialisation. The very first Hololens presentation video hinted exactly at this and the quality of the videos has been steadily improving.

Either way you want to look at it, the virtual and physical worlds are more blended together than ever. No large company can afford to look the other way.

English

English  Français

Français